Picking the “right” stock is akin to betting on a game; not only one has to pick the right team (Beta) but also by how much (Alpha) ~ Lumen Global Investments

It’s undeniable that the most influential event shaping financial markets over the past few decades has been the extraordinary and unprecedented decline in yields across major financial markets. This historic financial phenomenon is unlikely to be replicated in our generation – making it a once-in-a-lifetime occurrence and making the job of asset allocator a lot more challenging going forward.

The combination of valuations and earnings normally influences market performance. Valuations in turn are strongly tied to the long-term forward-looking discount rate applied to earnings, which, in turn, is intricately connected to and determined by the prevailing long-term yields. In essence, the performance of financial markets is a delicate interplay between these crucial elements, with long-term yields being the anchor that guides the valuation of assets and, consequently, their performance.

Despite undeniably generating considerable benefits for financial markets, especially for those dependent on leverage, it’s equally clear that the era of ever-lower yields culminating in historically cheap financing has distorted valuations and resulted in a generous allocation of capital. In essence, the era of “free money” turned out to be the proverbial tide that lifted all the boats … raising the fortunes of nearly all market participants. As the saying aptly goes, when the tide eventually recedes, it will reveal “who is swimming naked”, i.e., revealing many distortions.

The “Alpha is Dead, Long Live Beta” Period …

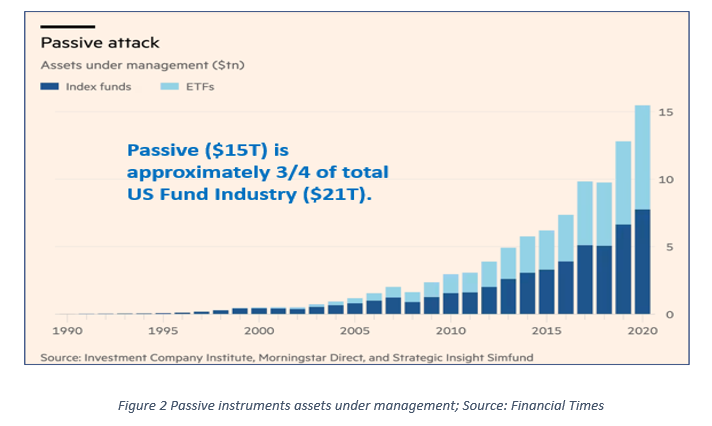

According to some pundits, one such dangerous distortion has been the unrelenting growth of passive investment strategies, exemplified by the growth of index funds and ETFs. According to these critics, the pursuit of higher returns in the context of historically low yields has prompted investors to venture further along the risk spectrum, i.e., the proverbial search or yield turning into a search for dividends. This shift has, in turn, overlooked the distinctions in fundamental value and risk among individual stocks, flattening performance. This decline in performance dispersion in turn has rendered the practice of stock picking appear futile and obsolete, thus encouraging investors to gravitate towards passive strategies, a.k.a. Beta investment strategies. Beta strategies, being fundamentally passive, allocate capital automatically to stocks primarily because they are constituents of a benchmark index, creating a feedback loop and further distortion. The outcome, as these pundits contend, has generated the most egregious misallocation of capital in the contemporary financial landscape.

The End of Financial Goldilocks …

… until 2022 when the historical rally came to an abrupt halt and a steadfast reversal. On March 16 of that year, the US Federal Reserve enacted the first of what would be the fastest and largest increase in policy rates in decades. The apparent goal: to arrest a stubborn inflation wave (initially dismissed as transitory). As it turns out, despite raising interest rates at ten consecutive meetings for a total of 5 percentage points, or the steepest spate of rate hikes in forty years, inflation, while abating some, remains stubbornly above the stated target of 2 per cent, thus leaving the door open for further rate hikes … and rise in yields. Ditto for the rest of the world where inflation has proven tenacious or at least far from “transitory”. Thus, monetary policy and its transmission to yields remain restrictive in major markets, with the notable exception of China and Japan, although things are about to change in Japan as well.[1]

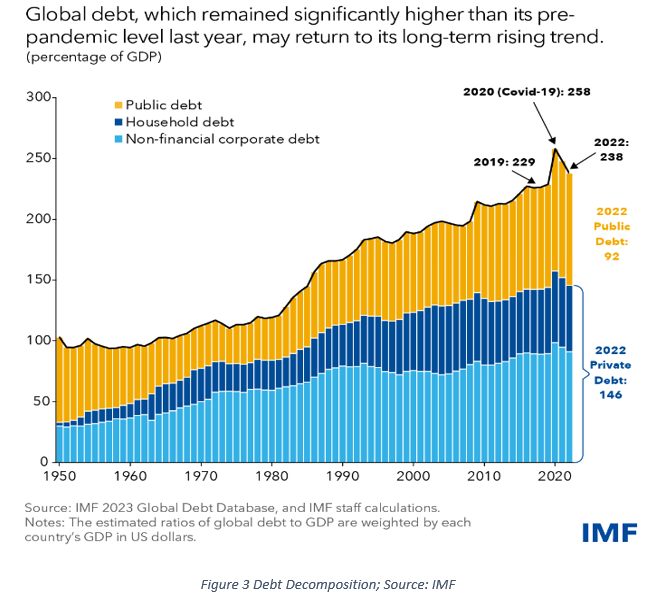

Irrespective of the trajectory of inflation, a concerning structural issue not commonly mentioned lies in the continuously expanding supply of public (and private!) debt. As per the latest projections from the IMF, even after discounting the disruptions caused by the COVID-19 pandemic, public debt is returning to its long-standing upward trend … but with a much higher price tag or yield as it were! With public debt already nearing or exceeding 100 per cent of GDP in many prominent cases, the recent upswing in yields is, from a straightforward arithmetic perspective, almost certain to lead to substantial fiscal deficits and consequently, more debt issuance … a vicious circle resulting in higher yields.

Then, adding to the negative projection for supply, there is the imperative for major central banks to shrink their balance sheets, often referred to as Quantitative Tightening, guaranteeing further and future pressure on yields globally. For example, assets on the US Fed’s balance sheet reached a historic peak of $8.96 trillion in April 2022, a whopping 36% of GDP that must be reduced. Since then, the Fed has engaged in a shrinking plan, selling (or letting maturing) on average US$70 billion a month, close to US$1 trillion per year! The task is not too different for the ECB, Bank of Japan, Bank of England, etc.

This Time is Different …

For the layperson, all the above could be considered part and parcel of a typical business cycle, or typical monetary policy stance aimed at managing inflation … were it not for the fact that time is (very) different! Rates will continue to go up and stay up. Indeed, after years of financial repression courtesy of unorthodox policies such as Quantitative Easing, ZIRP[2], NIRP[3], Yield Curve Control (Japan), and negative yields on tens of trillions of dollars (and euro) of public debt, policy rates and yields needed to normalize, i.e.., go back to levels reflecting long term economic and financial fundamentals. Add to that the sharp rise in inflation courtesy of an unusual combination of supply shocks, demand-pull, and Covid-induced fiscal largess, all fueled by a wall of liquidity, and the major monetary authorities could no longer sit idle and had to engage in the most aggressive monetary-tightening campaign in four decades, to normalize rates thus putting an end (and for good!) to the historical rally in fixed income.

Markets have reacted accordingly, with yields rising steeply and at a historically fast pace. For example, the 10-year yield on US Treasury bonds, or the global fixed income bell weather, has skyrocketed from a low of 0.66% on June 30, 2020, to about 5% currently, a staggering and remarkable move! And it is not over yet: e.g., real 10y yields of ~2.5%, albeit sharply higher from negative levels reached during the pandemic, are still far from their previous pick of above 4% in 1999 … there is room for both nominal and real yields to go up some more!

The Days of (Financial) Reckoning …

No matter the differing expert opinions on where yields will eventually stabilize, there is no question that the historical bond market rally is over. Yields are normalizing relative to the shenanigans of QE, ZIRP, etc., i.e., putting it in market parlance, yields are not going to be just “higher for longer” but “higher forever”.

“Normal” yields in turn will usher in considerable transformation in the financial landscape, with challenging implications for all those strategies that rely on leverage (and have relied on cheap financing), e.g., private equity, M&A, Hedge Funds, etc. The performance of the great majority of these strategies has already been notoriously and persistently poor relative to major benchmarks (S&P, Small Cap); it can be safely assumed that higher yields will make outperforming even more difficult.

“Normal” yields are also having a profound impact on the wealth management industry where the staple, convenient albeit thoughtless cookie-cutter 60/40 asset allocation no longer works as intended. In fact, for the first time since benchmarks were built, the major fixed-income indexes are on track to lose money for the third year in a row, another historical first! The 40% allocation to bonds, intended to reduce risk and stabilize the portfolio, worked very well … so long as bonds were rallying! With the rally over, the bond allocation has become an embarrassing source of outright loss and volatility, thus leaving wealth managers scrambling for an alternative, more “researched” personalized asset allocation.

More generally and without a doubt, the resurgence of “normalized” yields will usher in a return to valuations grounded in underlying fundamentals, rather than relying on the crutches of cheap financing and leverage. Investors, or their managers, will need to embrace a more traditional approach to evaluating value, focusing on an investment’s capacity to generate future cash flow and returns. This fundamental shift highlights the reemergence of fundamental analysis as the central driver of investment decisions.

The “New” New Alpha …

An interesting outcome of this return to normal finance and fundamental valuations is that it has emboldened a cohort of active managers who now declare a resurgence of stock picking to outperform major benchmarks. I.e., Alpha is coming back roaring! Their implicit argument is that the decades of lackluster performance in active management, including alternative strategies, ought to be attributed “solely” to the distortions caused by interest rates and yields. However, this narrative misses a crucial point.

Indeed, the inconvenient truth is that markets have undergone a profound transformation and become a lot more efficient due to the widespread availability of global communications, vast quantities of macro and micro data, and the immense computing power available almost for free. As a result, public and pertinent information about individual stocks is disseminated and acted upon instantly by a multitude of “traders” situated all around the globe and arbitraged away instantly … the definition of market efficiency! With this highly interconnected and efficient setup, it has become exceedingly challenging for active managers to consistently outperform benchmarks and justify their active fees, regardless of their exceptional cognitive abilities. Indeed, the issue of poor performance is decades old[4] and, despite what is mentioned above, is tangential at best to the rally in bonds. To be sure, passive management is a result of poor performance, not the other way around. I.e., stock picking is truly obsolete and overrated, irrespective of the distortion generated by the era of ever-lower yields!

Yet, there is a silver lining. Active management (i.e., beating a benchmark) is not over, it has instead migrated from stock picking to active asset allocation, i.e., building a portfolio with exposure across different asset classes, regions, countries, markets (developed, emerging, frontier), sectors & industries, themes, factors (growth, value, dividend, low risk), etc. What’s more is that courtesy, according to some, of the defunct bond rally, there are now more than 9,000 ETFs covering all these corners of the global financial markets, thus making active asset allocation cheap, effective, and profitable. Rather than wasting energy trying to “pick” the right stock[5], active managers have now better-than-even chances to generate Alpha by picking instead the “right” asset class, the right market, the right sector, factor, theme, etc. With valuations no longer distorted by ever-lower yields, active managers can now exploit this “new” vast array of granular and global opportunities. I.e., Alpha is dead, long live the New Alpha!

Simon Nocera

Lumen Global Investment

San Francisco, October 2023

[1] There is a strong expectation that the Bank of Japan will stop its Yield Curve Control policy, whereby 10-year yields are managed to stay below 1 percentage point.

[2] Zero Interest Rate Policy

[3] Negative Interest Rate Policy

[4] According to SPIVA, 95 % of actively managed funds have underperformed their benchmark over the past few decades. See: https://www.spglobal.com/spdji/en/research-insights/spiva/.

[5] Note: picking the “right” stock is akin to betting on a game; not only one has to pick the right team (Beta) but also by how much (Alpha).