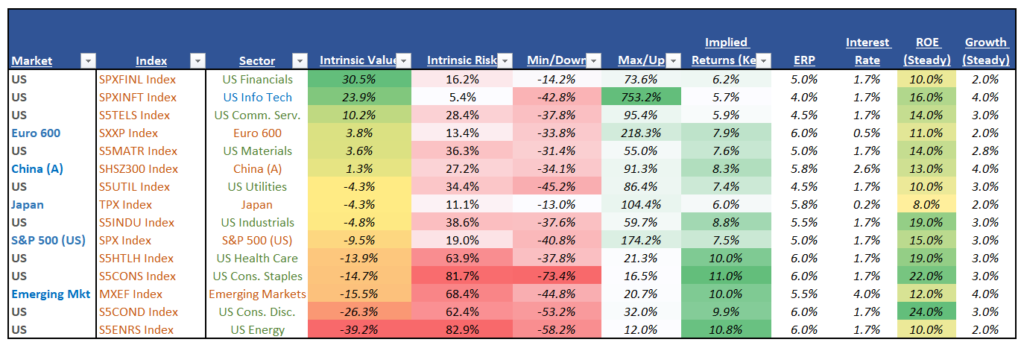

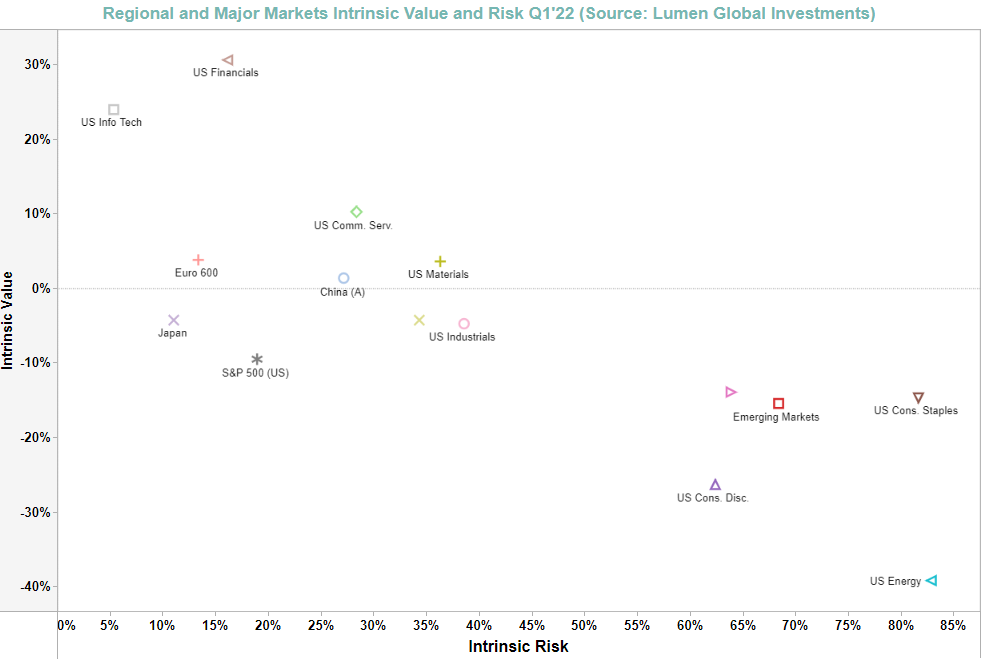

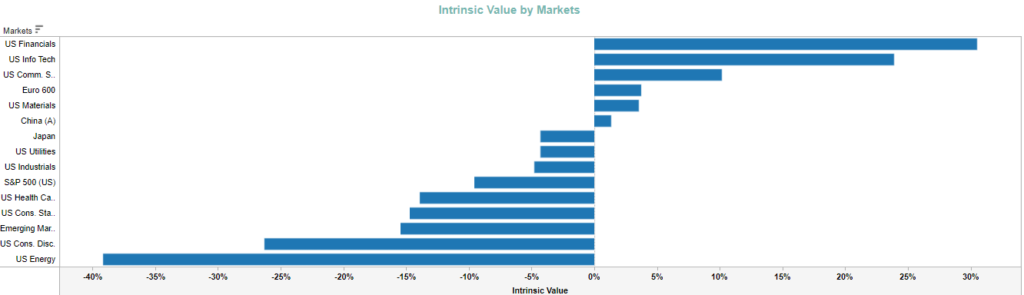

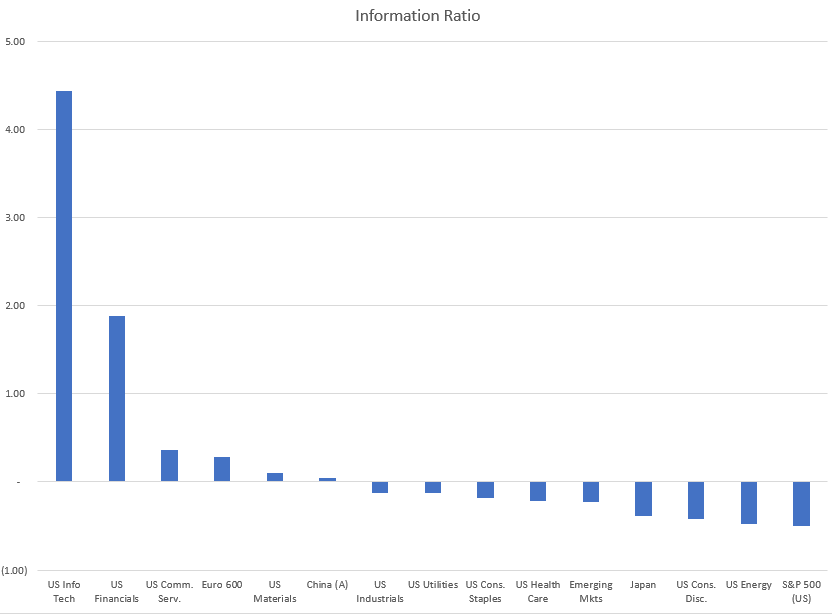

Ranking of Regional and US Sectors Applying the Residual Income Model and the Lumen-calculated Market Implied Expected Returns/Cost of Equity

Note: In the most practical and coherent definition, financial risk is the possibility of losing capital permanently, to be sure, it has nothing to do with the preposterous practice out there to confuse risk with volatility and precisely measure it with the standard deviation of an allegedly normal distribution of returns (Bell Curve). Thus, it stands to (our) logic that risk is essentially a lack of value, i.e., if an investment has zero fundamental value, it stands to reason that it has one hundred percent risk and vice versa. Accordingly, “intrinsic” risk is inversely correlated with intrinsic value. At Lumen, we measure intrinsic risk by stress-testing a Residual Income Model across its major inputs and using our proprietary estimate of market-implied expected return as the discount rate.

Contact us to learn more about our asset allocation and outlook.

Check our Visualizations page to see an interactive graph.